nj bait tax example

As State Taxes paid. 0 4 214 Reply.

![]()

Pdf The Dark Patterns Side Of Ux Design

NJ BAIT Tax Base For resident partners the base for calculating the NJ BAIT will include income from all sources as opposed to only NJ sources under the old rules.

. Now if we apply the max rate in 2020 37 that will result in a tax of 31966 to each member. Pass-through entity AB has 2 New Jersey resident members with total income of 1500000 that is 100 sourced to New Jersey. Partners with a calendar year end of 123122 will claim credit for their share of the 2021 BAIT on their 2022 New Jersey tax returns.

Were going to take a deduction for the New Jersey BAIT paid in 1581750 resulting in 25918250 a federal income and allocated the three ways. The BAIT is an elective tax regime effective for tax years beginning on or after January 1 2020 whereby qualifying pass-through business entities may elect to pay tax at the entity level. The New Jersey Business Alternative Income Tax also referred to as BAIT or NJ BAIT helps business owners mitigate the negative impact of the federal state and.

The tax rates for NJ BAIT range from 5675 to as high as 109 on New Jersey sourced income. Pass-Through Business Alternative Income Tax Act. This new law allows pass-through businesses to pay income taxes at the entity level instead of the personal level.

Since the NJ BAIT tax is being paid by the pass-through entity the state will interpret and apply the principles of this type of entity tax and the corresponding credit that would have been available if the tax was paid by the individual owner differently. For example if the NJ BAIT credit flows to a Trust from an S. PL2019 c320 enacted the Pass-Through Business Alternative Income Tax Act effective for tax years beginning on or after January 1 2020.

Were going to take a deduction for the New Jersey BAIT paid in 1581750 resulting in 25918250 a federal income and allocated the three ways 8639417. However my understanding is that the NJ BAIT payment is deductible as a business expense of the PTE in my case an S-Corp. Tax is imposed on the sum of each members share of distributive proceeds which is 1500000.

Hence I need to record it as an expense on my 1040 to offset the income reported on the K-1. Consider the following simplified example. 3246 or bill establishing the business alternative income tax BAIT an elective New Jersey business tax regime for pass-through entities PTEs.

S corporation S has net income of 1000000 in 2020 and one individual shareholder A. Income in excess of 1 million is taxed at 109. The New Jersey pass-through entity tax took effect Jan.

For New Jersey purposes income and losses of a pass-through entity are passed through to its. On January 13 2020 Governor Phil Murphy signed into law Senate Bill 3246 S. Until 2022 there is a middle bracket of 912 for income between 1M and 5M.

By passing through a net amount of income reduced by the SALT deduction the owner is able to fully deduct their New Jersey taxes for federal purposes. The distributive proceeds sourced to New Jersey are allocated 750000 to Member A and 750000 to Member B. By explicitly stating New Jersey will allow credits for similar tax regimes eg Connecticut the Division appears to be inviting other states to.

The New Jersey Division of Taxation has provided answers to several recent questions about the New Jersey Business Alternative Income Tax BAIT. On January 18 New Jersey Gov. Changes are effective for tax years beginning on and after January 1 2022.

24000 400K x 6 24000 400K x 6 The NJ BAIT tax deducted at entity level would be added back to taxable earnings for the calculation of NJ income tax. Mechanics of the BAIT Election. BAIT is a perfect example of a tax law that can only be taken advantage of with.

Bracket Changes As a result of the amendments the BAIT increases to the top rate of 109 on firm income over 1M. Phil Murphy D signed S 4068 which revises the Business Alternative Income Tax BAIT by amending the calculation of the tax base ie distributive proceeds to include all of the distributive share of partnership income of residents that is subject to tax under the New Jersey Gross Income Tax Act. However as t he BAIT enables owners of PTEs to reduce their federal taxable income by remitting this entity-level tax on its New Jersey-sourced income where in 1120S this payment should be shown.

Nonresident Withholding The new 2022 BAIT does not require a partnership or LLC taxed as a partnership to withhold New Jersey gross income tax. Pass-Through Business Alternative Income Tax Act. For the 2020 tax year the four tiers of income tax rates are as follows.

However it is not reported on the 1120-S schedule K-1. 388000 50 of 800K less 24K of NJ BAIT deducted at entity level Federal Income Tax. Partners with a calendar year end of 123122 will claim credit for their share of the 2021 BAIT on their 2022 New Jersey tax returns.

The NJ BAIT tax payment is made by SCorp after registering at NJ Pass Thru BAIT. This seems logical as NJ residents are taxed on their entire share of partnership income from all sources. For example in 2018 and 2019 a taxpayer paying 15000 in property taxes on their New Jersey home and 20000 in state income tax would have been limited to an overall 10000 SALT deduction on their individual tax return.

42788750 plus 109 for distributive proceeds over 5000000. 1418750 plus 652 for distributive proceeds between 250000 and 1000000. Or years where the.

Level 6 February. Prior to the amendment. From this calculation we can see that our elective entity tax is 73987 for the collective 3 members.

63087 10900 1100000 1000000 100000 x 109 10900 73987. Finally we add the 63087 base to the 10900 tax to obtain the elective entity tax. 140000 400K x 35 135800 388K x 40 NJ Income Tax.

419 revises the New Jersey elective pass-through entity business alternative income tax which was enacted in January 2020. Assume a PTE filed its 2021 BAIT return on March 1 2022. Lets say that the partners share of the BAIT on New Jersey taxable income is 100000.

The BAIT program is intended to give New Jersey individual income taxpayers a work-around of the 10000 annual limitation on the. The purpose of this NJ state approved program is to avoid the 10000. 6308750 plus 912 for distributive proceeds between 1000000 and 5000000.

The value of that deduction on the federal return assuming the maximum marginal rate of 37 is worth 37000 but the potential loss of the resident credit on the out-of-state partners tax return is the full 100000.

Mpe1 Senses The Polyadenylation Signal In Pre Mrna To Control Cleavage And Polyadenylation Biorxiv

State Local Tax Possible Tax Changes Ahead

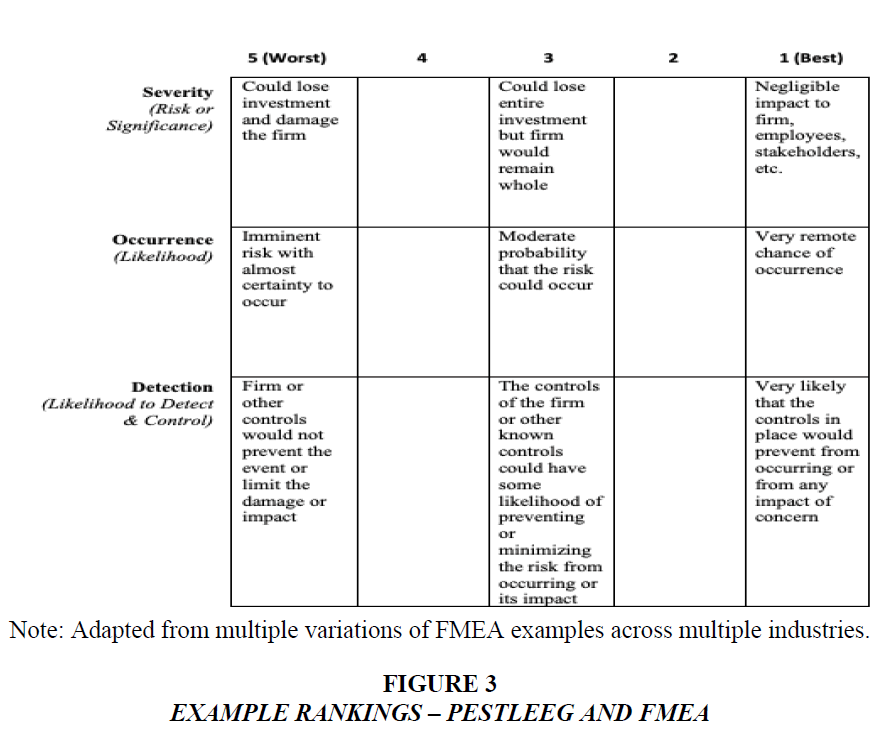

External Factors And Risk Considerations Applying The Institutional Based View Of Management

Pdf The Dark Patterns Side Of Ux Design

Pdf Building Consensus Around The Assessment And Interpretation Of Symbiodiniaceae Diversity

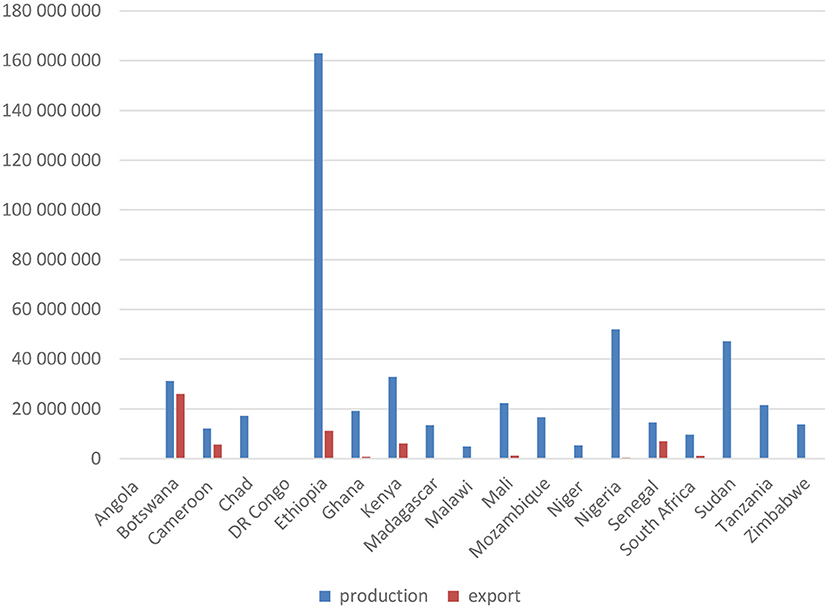

Frontiers Access To Veterinary Drugs In Sub Saharan Africa Roadblocks And Current Solutions

Pdf Nepalese Journal Of Agricultural Sciences Vol 22

Mpe1 Senses The Polyadenylation Signal In Pre Mrna To Control Cleavage And Polyadenylation Biorxiv

10 Best Tax Software Of 2022 Money

Pass Through Entity Taxes May Require U S Gaap Considerations 2021 Articles Resources Cla Cliftonlarsonallen

Pdf The Dark Patterns Side Of Ux Design

What Is Hybrid Learning Can You Explain In Detail About It Quora

Dental Insurance 101 In 2022 Dental Insurance Plans Dental Insurance Dental Coverage

Getting To Know You Confirming Target Suitability Springerlink

Pdf The Dark Patterns Side Of Ux Design

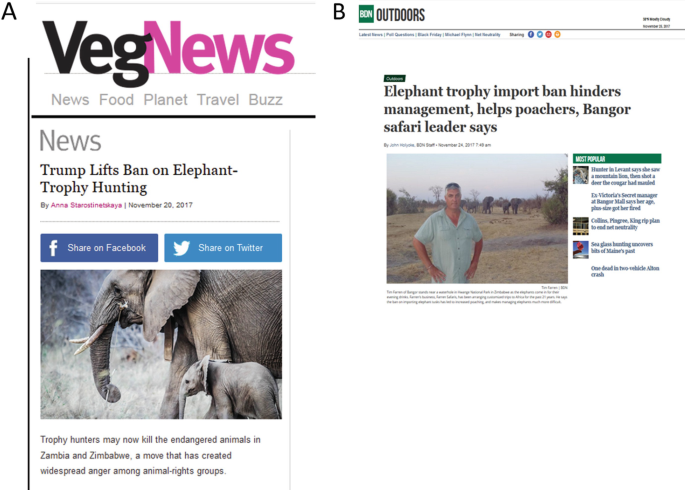

Alternative Facts And Alternative Views Scientists Managers And Animal Rights Activists Springerlink

Mpe1 Senses The Polyadenylation Signal In Pre Mrna To Control Cleavage And Polyadenylation Biorxiv

Mpe1 Senses The Polyadenylation Signal In Pre Mrna To Control Cleavage And Polyadenylation Biorxiv